top of page

Lumos Alpha

Blog

Search

Lumos Alpha Portfolio Update — November 2025

In November 2025, Lumos Alpha’s Quant Portfolio I incurred a loss. The cash account posted a monthly return of -4.85%, while the year-to-date (YTD) return remained strong at 36.4%. The margin accounts experienced a more pronounced drawdown, with monthly losses in the range of -8% to -15%, depending on the leverage ratio relative to equity. There were two primary drivers behind the larger losses in the margin accounts this month: High use of leverage in a historically favorabl

Zhilin Zhang

Nov 30, 20253 min read

2025年11月Lumos Alpha投资组合简报

2025年11月,Lumos Alpha的量化策略投资组合I类(Quant Portfolio I) 出现了损失。现金账户(Cash Account)月收益为-4.85%;从年初至今,该投资组合共获得36.4%的收益。而融资账户(Margin Account)在本月的损失更大,在 -8% 到 -15%之间(具体取决于融资金额与本金的比例)。 融资账户在本月发生如此大的原因主要有二: 其一,本月我们使用融资资金比例非常高。因为过去十多年,11月里科技股上涨的概率都是全年最高的月份之一。所以算法考虑到这种季节性效应,对融资账户增加了融资比例,且融资资金主要买入科技类股票。而恰恰今年11月科技股因Michael Burry的做空报告表现并不佳。 其二,另外一个 主要原因在于 Michael Burry 的对NVDA和PLTR做空消息,引起市场对某些科技股尤其是AI股产生恐慌抛售,导致我们融资资金所持有的几只重仓科技股在很短时间内就产生两位数以上的跌幅,比如NVDA, PLTR,以及与此关联的其它股票。关于Burry对NVDA和PLTR的看法,我们有一些

Zhilin Zhang

Nov 30, 20252 min read

Lumos Alpha Portfolio Update — October 2025

Quant Portfolio I In October 2025, Lumos Alpha’s Quant Portfolio I executed two algorithmic trades and delivered a total monthly return of 7.09% . The portfolio has produced a Year-to-date (YTD) return of 43.3% . Quant Portfolio II Quant Portfolio II executed three algorithmic trades in October and achieved a monthly return of 10.73% . This portfolio has generated a YTD return of 66.7% . Flagship Portfolio The Lumos Alpha Flagship Portfolio returned 2.78% in October 2025, br

Zhilin Zhang

Nov 1, 20252 min read

2025年10月Lumos Alpha投资组合简报

2025年10月,Lumos Alpha的量化策略投资组合I类(Quant Portfolio I)进行了2次算法交易,累计获得7.09%的月收益。从年初至今,该投资组合共获得43.3%的收益。 量化策略投资组合II类(Quant Portfolio II)进行了3次算法交易,获得10.73%的月收益。年初至今,该投资组合共获得66.7%的收益。 Lumos Alpha 旗舰投资组合在10月收益为2.78%,年初至今共获得收益18.9%。该投资组合在10月虽然收益略高于标普500指数基金,但仍旧不尽如人意。主要原因是近几个月价值股票(value stocks)表现远远低于增长股票(growth stocks),而本旗舰投资组合包含了较大比例的价值股票。另外一个原因是本投资组合里有个别重仓股票表现不佳——但我们认为属于股票正常波动现象,和公司自身的商业模式和盈利无关。所以请持有本旗舰投资组合的客户们保持耐心。 旗舰投资组合在10月份也按照原定计划做了部分调整。我们卖出了一只成长股,两只价值股,所得资金少部分用于增持已有的成长股,大部分分配给Quan

Zhilin Zhang

Nov 1, 20251 min read

Lumos Alpha Portfolios: Q3 2025 Review and Outlook

The third quarter of 2025 has concluded. Below is a performance summary for the three portfolios managed by Lumos Alpha: Quant Portfolio...

Zhilin Zhang

Oct 8, 20253 min read

Lumos Alpha 投资组合2025年第三季度回顾与展望

2025年第三季度结束。Lumos Alpha管理的三个投资组合分别取得如下收益: 量化投资组合 I类:第三季度收益16.0%,2025年前三个季度收益33.8% 量化投资组合 II类:第三季度收益23.8%,2025年前三个季度收益50.6%...

Zhilin Zhang

Oct 8, 20254 min read

What's Your Gold and Crypto Allocations?

Every six months, Callum Thomas runs a Twitter survey asking a simple question: Are you allocating to gold or bitcoin/crypto? The latest...

Zhilin Zhang

Aug 12, 20252 min read

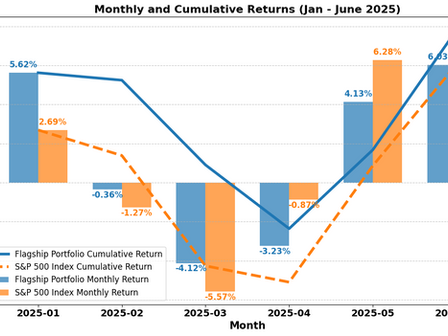

Lumos Alpha Flagship Portfolio 2025Q2 Investment Report

Portfolio Performance As of June 30, 2025, the Lumos Alpha Flagship Portfolio delivered a year-to-date (YTD) return of 7.81%....

Zhilin Zhang

Jul 5, 20253 min read

Lumos Alpha Q1 2025 Investment Report

Portfolio Performance In the first quarter of 2025, the Lumos Alpha Flagship Portfolio delivered a return of 0.93% , outperforming the...

Zhilin Zhang

Mar 31, 20252 min read

bottom of page